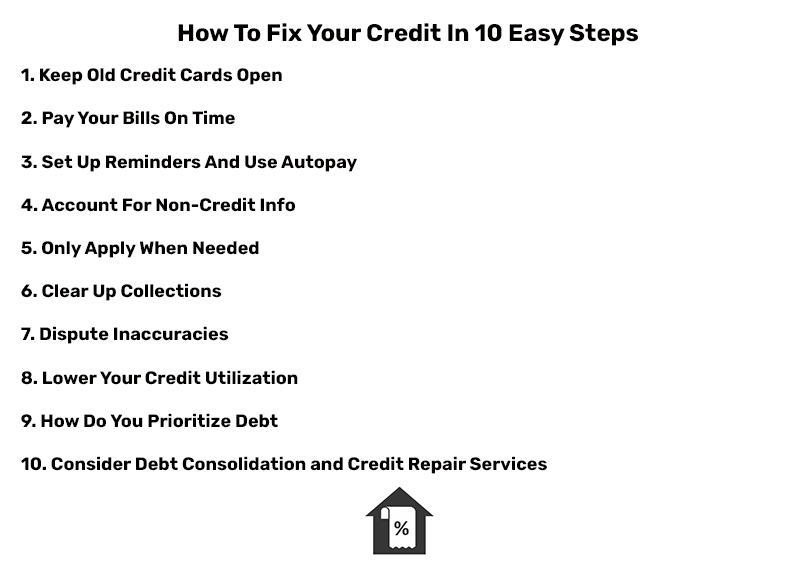

How to Fix Your Credit In 10 Easy Steps

Your credit score is one of the most critical numbers in your life because it impacts so many events. For example, your credit score determines the type of car loans you are eligible for, the rate on your credit card, and whether you rent an apartment or buy a home. For this reason, it is critical to know your credit score and understand how to improve it.

A high credit score opens you up to more options and can save you money with lower rates.

There are several things you can do to improve your credit score. Some things are as quick as picking up the phone while some strategies take a little more time. Here are some things you can do to set up your credit score to work for you rather than against you.

The first step in repairing your credit score is to check your credit report to see what is being reported and what areas impact you the most. Armed with this information, you can prioritize tasks to use your time most effectively.

Without further ado, let's get started.

-

Keep old credit cards open.

Old and active credit cards keep your credit age high and contribute to your overall credit. It also helps your utilization ratio.

Some companies may close old cards if they don't see any activity. One way around this is to automate payments with the card. For example, set up autopay for a bill to the card and then set up autopay from your bank account.

There are times when keeping an older card open may not be the best option since some come with annual fees and additional expenses. If you need to close a card, calculate your utilization ratio with your remaining credit cards to see where your ratio will fall.

-

Pay your bills on time.

Lenders look to your payment history to see how you are likely to keep up with payments. Your payment history also has a significant impact on your score, and a single late payment can seriously drop your score.

Here are some things to keep in mind if you are catching up with your bills:

- Payments missed can remain on your credit report for up to seven years. As a result, it is essential to catch up on your bills since older, negative items have less effect than recent ones.

- Paying off a collections account won't remove the reason for the collection from your credit report. Collections reports may remain on your credit report for seven years.

- Contact your creditors beforehand if you know you will have trouble paying as they may forgive a single late payment if you have a positive history with them.

Once you have caught up with and paid things off, such as student loans and credit cards, you must leave them on your credit report. Removing them may decrease your credit age, removes your positive payment history, and some other things that lenders won't see if not included in your credit report.

There are some exceptions to consider, such as charged-off accounts, since they negatively impact your credit report even after they are paid off.

-

Set up reminders and use autopay

An easy way to keep abreast of payments is the automate them or set up reminders. The best strategy depends on how regularly and often you are paid. Here are some methods:

- Autopay – This option is best if your pay is regular, and have regularly timed expenses.

- Micropayments – With micropayments, you pay several times throughout the month. This works with irregular pay since you immediately put payments toward your debt when paid. If paid regularly, pay down purchases or simply set up autopay.

- Payment reminders – If you have irregular pay or other things sporadically impacting your finances, it is crucial to set up payment reminders to stay on top of your bills.

-

Account for non-credit info

Only things like loans and credit cards impact your credit score. However, things have changed. Today, you can factor things such as cell phone payments into your score. Experian Boost is one such service that allows you to factor in cell phone and utility payments into your score. This free, opt-in service connects with your bank accounts to verify these payments to consider them into your overall score.

UltraFICO is another service that enables you to connect your savings, checking, or money market accounts and have that additional information impact your credit score. Currently, in the Pilot Phase, UltraFICO is only being offered to a small group of lenders. Once the pilot phase is complete, it should be broadly available.

-

Only apply when needed.

Opening new credit accounts is not the best thing when you are trying to improve your credit score. Doing so can end up lowering your credit score rather than raising it.

Some of the reasons why include:

- Lower credit age: New cards lower your overall credit age. The length of your credit history is up to 15% of your credit score.

Hard inquiries: This is when a creditor has requested a look at your credit file.

- Too many of them raise a red flag with lenders. They signal that you may have had money issues and make you appear riskier. They stay on your credit report for two years and affect your credit score for the first 12 months.

Not all new credit is bad. Opening a new account may help in the long run if you manage it responsibly and don't apply for many accounts in a short period. It can also be helpful if you fixed previous credit issues and are now focusing on rebuilding your credit history.

-

Clear up collections

Collection accounts can hurt both your credit score and total debt. You could talk to your creditor to see if you can reach a payment agreement through a pay-for-delete letter. A pay-for-delete letter is a negotiation tool that asks a creditor to remove negative information from your credit report in exchange for paying off the balance.

If your creditor agrees to the terms, you will need to get the agreement in writing to ensure they follow through. Keep in mind that not all creditors will accept this type of arrangement, so it is not a guaranteed fix.

-

Dispute inaccuracies

You should regularly check your credit reports for mistakes and misrepresentations. According to the Federal Trade Commission, twenty percent have an error on at least one of their credit reports. As a result, you may have a discrepancy in your credit report and not even be aware of it. Inaccuracies can happen for a wide range of reasons, including purchases made by someone who stole your identity or incorrectly reported late payments from your lender.

TransUnion, Equifax, and Experian offer a free credit report annually through annualcreditreport.com. You can also receive a free credit report if a creditor or lender denies you. They are required to give you a copy of the credit report and score they used to render a decision.

Disputing items on your credit report takes some steps and entails contacting each bureau in addition to the entity that reported the information to the credit bureaus. After informing the credit bureaus, you will need to wait for them to complete their investigation and report back to you. This process typically takes 30 to 45 days to get back to you. You should also know that checking your credit does not impact your credit score.

-

Lower your credit utilization

Keeping balances low and paying down your debt directly impacts your credit utilization. Credit utilization is how much available credit you are using. For a single card, it is calculated by dividing your balance by your total available credit. It can be computed for all available credit by combining the balance of all of your credit cards and dividing by the total amount of credit available. You should monitor your individual and overall credit utilization to determine where you should prioritize your repayment efforts.

The time you pay your bill affects your credit utilization. Even though you may have paid your balance in full before your due date, creditors may have reported your balance to the credit bureaus before you made payment. When this happens, the credit bureaus may be under the impression that your balance is higher than what it is. However, this will only be the case for the month, and then everything will adjust. You can also prevent this issue from happening by asking your lender to report to the credit bureaus and making your payment before the reporting date.

The preferred utilization rate for lenders is 30 percent or below. A low utilization rate conveys to lenders that you can manage your debt, and you haven't maxed out on your credit cards.

-

How do you prioritize debt?

Paying down debt takes time. The question for many is, where do you start? Fortunately, there are a couple of repayment strategies to select from with the best one, depending upon your financial situation.

The debt repayment strategies to consider include:

- Avalanche Method – This strategy calls for making the minimum payment on every account owed, except for the account having the highest interest rate. For that one, you will pay the most that you can pay to pay it off as quickly as possible. Once paid off, you will move onto the account with the next highest interest rate. This strategy usually results in saving the most money in the long run. However, it also requires the most discipline.

- Snowball Method – This is the exact opposite of the Snowball Method and focuses on paying off accounts with the lowest balance first. After paying off an account, you will use the money initially allocated to that account for the next smallest account. This strategy uses "momentum" and is said to motivate people to keep going since you are paying off balances quicker and more frequently than the Avalanche method. A disadvantage to the Snowball Method is that it may cost more in the long run.

Regardless of the approach, you should take on your debt as quickly as possible to eliminate feeds and interest and raise your credit score.

-

Consider debt consolidation and credit repair services.

Depending upon your financial situation and your motivation, it may be in your best interest to consider credit repair services or debt consolidation.

You are probably asking yourself, what is the difference between the two?

Debt consolidation

Debt consolidation entails bundling credit card payments into a single monthly payment through a personal loan, zero-percent balance transfer credit cards, or other methods. Keep in mind that the best option will depend upon your specific financial situation.

- Advantages

- Can help you make payments on time

- Easier to manage since it is a single payment

- Can increase the payment period

- Can be easier to put aside savings

- Potentially lower monthly payments

- Possibly get a lower interest rate

- Disadvantages

- Can be expensive

- Creates a credit inquiry

- Can potentially shorten the payment period

- You lose your account history when you close the account.

- It is hard to discharge consolidation loans when declaring bankruptcy

Credit restoration services

In contrast, credit restoration is a process that involves fixing unverifiable, incomplete, biased, or otherwise incorrect information on your credit report to improve your credit score. Rather than paying down debt, you dispute inaccuracies and clear up errors on your credit report.

- Advantages

- Credit reports are analyzed by experienced professionals who know what to look for understanding how the system works

- Receive ongoing support for long cases

- Receive help disputing incorrect information with creditors and credit bureaus

- Saves time

- Disadvantages

- It can be costly to do yourself

- It can be complicated to do yourself

- It can require extensive time to complete each step if you are doing it alone.

Know what affects your credit score

Now that we have gone over several ways to improve your credit, we should discuss what goes into your credit score. The five main components making up your credit score, include:

- Payment History (35%) – Consistent on-time payments are the highest weighted part of your credit score. Missed or late payments can drastically impact your score.

- Credit Utilization (30%) – The lower your utilization ratio, the better. Your utilization score is calculated by comparing the amount of credit you are using to the amount available.

- Length of credit history (15%) – Your overall credit history is a smaller but still influential role impacting your credit score. Your credit history gives your lender a better picture of your overall financial responsibility and risk. An extended credit history is to your advantage and gives lenders more information to consider.

- Types of credit (10%) – Your credit mix influences your credit score. Successfully managing a broad credit portfolio shows your ability to handle different types of credit responsibly.

- New Credit and inquiries (10%) – Requests to open a new line of credit are called inquiries, and they can take a toll on your score. Excessive hard inquiries negatively impact your score since they signal to lenders that you are looking to increase available credit, representing a potential risk. However, some inquiries made in a short period for homes and auto loans may not significantly impact your credit since such activity indicates that you may be shopping for the best bargain.

Money owed in a tax lien, court judgment, bankruptcy, or charge off can decrease your credit score, making it increasingly difficult to get approved.

How long to rebuild credit

Once your credit has been impaired, it takes time to rebuild your credit score. Just how long depends upon the types of negative items on your report and the extent of your credit history.

For example:

- Credit inquiries remain on your credit report for two years.

- Delinquencies last seven years

- Most public record items last for seven years. However, bankruptcies can remain for ten years.

The critical thing to remember is that there are no shortcuts or quick fixes to rebuilding your credit. You will need to consistently work on the different factors affecting your score to improve it. As with life, good habits are the key to success.

Establish credit without a credit history

If you have little to no credit, you will have a "thin" credit file. If you don't have any credit, lenders don't have anything to render a credit decision.

If you don't have a credit history, it may take three to six months to build your account.

To begin establishing credit.